Stirling Property Funds has acquired, Junction Fair, a neighbourhood shopping centre in Newcastle from funds manager Fortius following an extended settlement period resulting from the COVID-19 pandemic. Fortius sold the neighbourhood centre for $47 million after purchasing the property six-years ago for $32 million.

Fortius acquired the neighbourhood centre in late 2014 and undertook a major refurbishment and remixing of the asset. The centre was originally acquired with over half of the specialty shops vacant. Fortius subsequently leased all the vacant shops creating a thriving community and lifestyle hub.

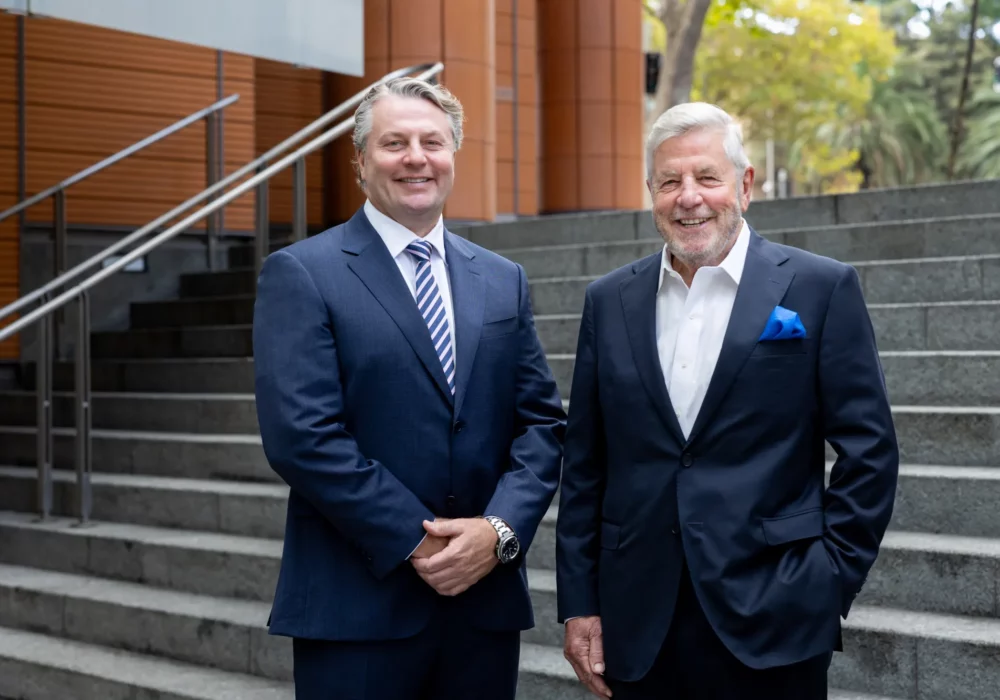

Fortius chief executive Sam Sproats said he was pleased with the investment outcome. He had negotiated the contract with Stirling before COVID-19 struck.

“The speed of the pandemic and isolation restrictions had created uncertainty but neighbourhood shopping centres had proven their resilience – footfall and retail sales were returning to normal. “Inner urban and neighbourhood centres continue to be a key target area and sector whereby Fortius’ skillset can be utilized. We are keenly focused on assets with multiple income streams, underpinning solid cashflow returns and some vacancy to secure commitments.” said Sprouts.

Junction Fair is a non-discretionary-focused neighbourhood shopping centre anchored by a Coles supermarket and located in The Junction, 1.5 kilometres south of the Newcastle CBD, close to Merewether Beach. The site has 7226m2 of lettable area, 231 car spaces and sits on 11,250m2 with four street frontages. The centre’s non-discretionary and service-based tenants account for 77% of its lettable area. Coles provides 50% of the property’s income and its lease runs until 2027 with two 10-year options.

Matthew Hyder, CEO of Stirling Property Funds, said Stirling have employed a defined investment strategy of acquiring quality income producing assets that demonstrate compelling, relative value to other property sectors, which also stand to benefit from recent government infrastructure investment coupled with growing local demographics.

“This is consistent with Stirling’s earlier acquisitions in Macquarie Park and Liverpool, which are on target to deliver superior total returns for our investors.

“A couple of elements were very attractive with this acquisition. First is the significant yield premium on offer relative to standalone supermarkets and second was the very strong relative value to office assets. As we continually assess new opportunities, we remain focused on assets that align with our value focused investment strategy.”

“Junction Fair had demonstrated its strong non-discretionary nature during COVID-19, with April 2020 sales up 22% year on year and 91% of its tenants keeping their outlets open compared with discretionary weighted shopping centres where just 37% of the tenants stayed open.” said Hyder.

Stonebridge Property Group’s Philip Gartland in conjunction with JLL’s Nick Willis, who negotiated the sale said this is a really encouraging result for the retail investment market.

JLL’s Director of Retail Investments, Nick Willis said, “Despite the changes and evolution we are experiencing in retail, we continue to deal with a significant weight of capital looking to deploy into the sector. This capital has largely either identified the resilient nature of neighbourhood shopping centres like Junction Fair and a reweighting towards sub-sector, or the opportunity in typically sub-regional assets where repositioning development opportunities to alternative uses are becoming more prevalent.”

“What COVID-19 has very much reinforced is the importance of non-discretionary retail and the important role that town centre assets have in serving the community and we are anticipating strong demand for this style of asset in the second half of 2020,” Stonebridge’s Philip Gartland said.

Hyder continued, “Stirling’s investment strategy was to acquire quality income-producing assets that demonstrated relative value to other property sectors, particularly in areas with government spending on infrastructure and where there was a growing population.”

Junction Fair equity raising of $25 million had been oversubscribed and completed in just more than two weeks. In 2018, Stirling bought its first property, an office/warehouse asset in Macquarie and its second property last year at 203 Northumberland Street, Liverpool, for $47 million.